Principal 401k withdrawal calculator

Ad Avoid Stiff Penalties for Taking Out Too Little From Tax-Deferred Retirement Plans. The Early Withdrawal Calculator the tool allows you to estimate the impact of taking a hypothetical early withdrawal from your retirement account including potential lost.

Retirement Withdrawal Calculator

401 k or Other Qualified Employer Sponsored Retirement Plan QRP Early Distribution Costs Calculator Print Share Use this calculator to estimate how much in taxes you could owe if you.

. The Early Withdrawal Calculator the tool allows you to estimate the impact of taking a hypothetical early withdrawal from your retirement account including potential lost asset. Planning Tools Calculators Find useful tools and resources for tracking your savings progress estimating your coverage needs and taking control of your financial future. And the leftover sum you.

You will find the savings withdrawal calculator to be very flexible. The Retirement Wellness Planner information and Retirement Wellness Score are limited only to the inputs and other financial assumptions and is not intended to be a financial plan or. To get the most out of this 401 k calculator we recommend that you input data that reflects your retirement goals and current financial situation.

The goal of a retirement withdrawal calculator is to figure out how much you withdraw from savings without running out of money before you run out of life. 25Years until you retire age 40 to age 65. Log in to your account.

Individuals will have to pay income. Using this 401k early withdrawal calculator is easy. You decide to increase your annual withdrawal by 35 and want the money to last for 35 years with nothing left for heirs after that time.

Not an easy task. Learn More About Potential Lost Asset Growth Tax Consequences Penalties At TIAA. As its name suggests this strategy implies withdrawing a fixed percentage of your account balance each year for example taking out 3 or 4 of your total balance every single.

It simulates that if you contribute. Ad If you have a 500000 portfolio download your free copy of this guide now. This is a very.

Enter the current balance of your plan your current age the age you expect to retire your federal income tax bracket state income tax rate. This 401k contribution calculator helps streamline the process of figuring out how much you should contribute toward your 401k to meet your future goal. Use the forms below to request a distribution or redemption from your Principal Traditional IRA Roth IRA SIMPLE IRA SEP IRA or 403b7 accountSubmit completed forms.

While it is most frequently used to calculate how long an investment will last assuming some. Ad Use Our Early Withdrawal Calculator Tool To Understand The Potential Impacts. If you dont have data ready.

The 2 trillion CARES Act wavied the 10 penalty on early withdrawals from IRAs for up to 100000 for individuals impacted by coronavirus. 2 1 IRS annual limits for 2022. The Nest Egg Withdrawal Calculator shows that the balance of the nest egg after 20 years is 55785366.

Understand What is RMD and Why You Should Care About It. For instance with a 50000 withdrawal you may keep just 32500 65 and pay 17500 35 in taxes and penalties depending on your state and tax bracket. The 6 annual rate of return offsets the 5 withdrawal rate and 3 inflation rate.

To give you an idea 20000 in a 401 k 403 b or 457 b account could triple in 20 years at an average 7 rate of returnbut not if you withdraw it today.

Compound Interest Calculator For Excel

Bond Price Finance Apps Tax App Financial Calculator

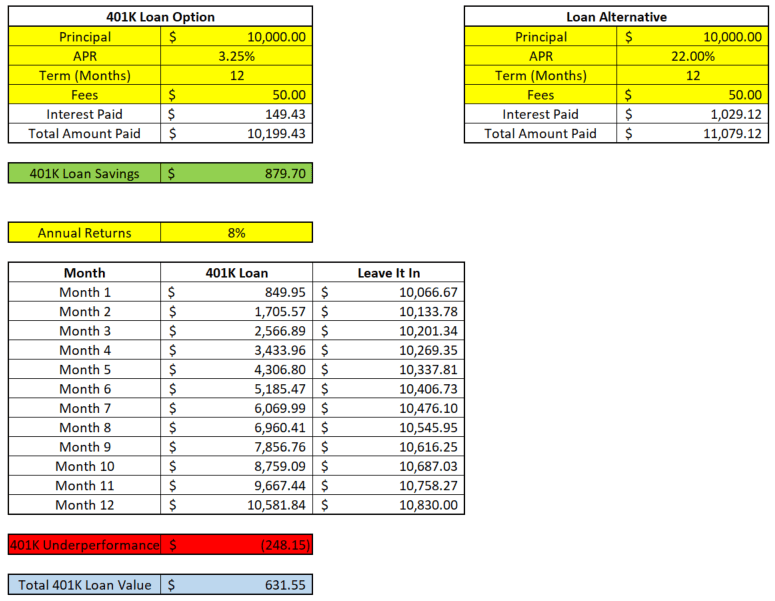

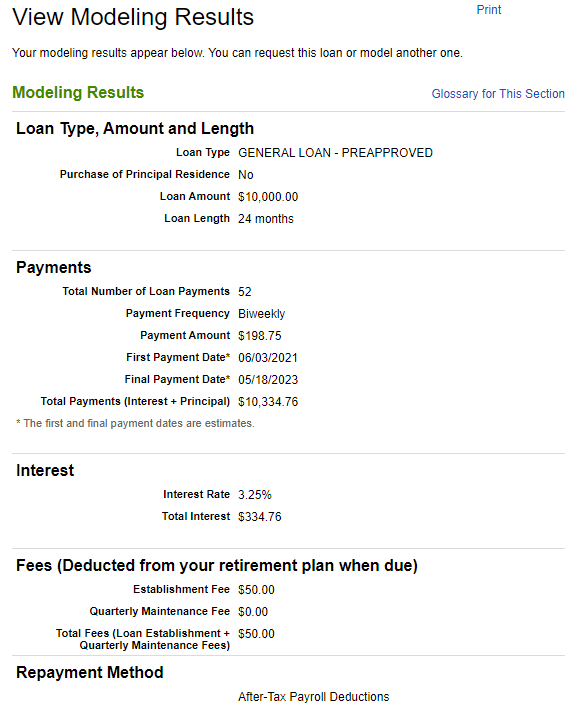

Use This Free 401k Loan Calculator To See If A 401k Loan Is Right For You

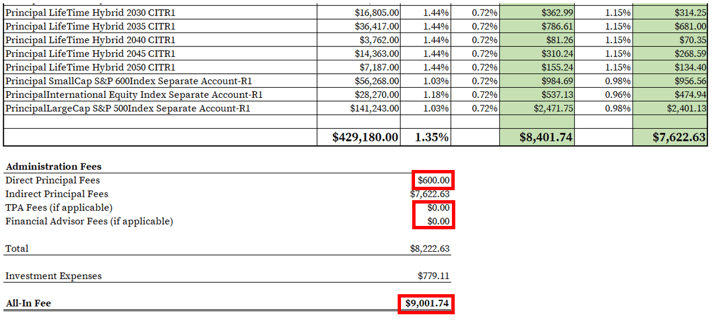

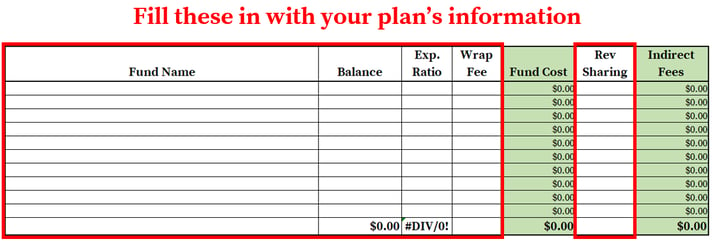

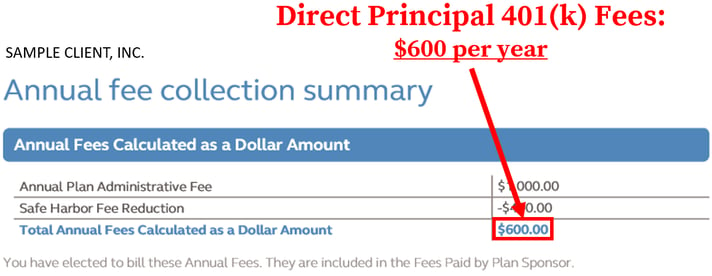

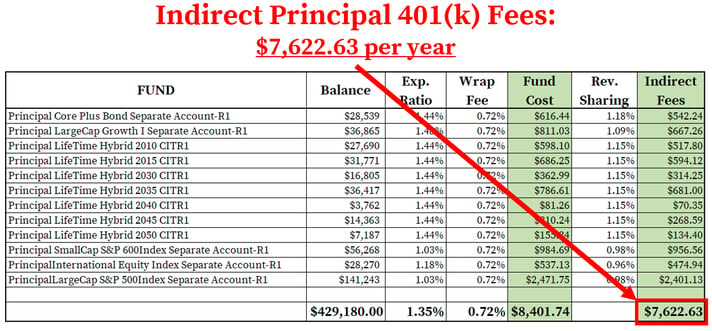

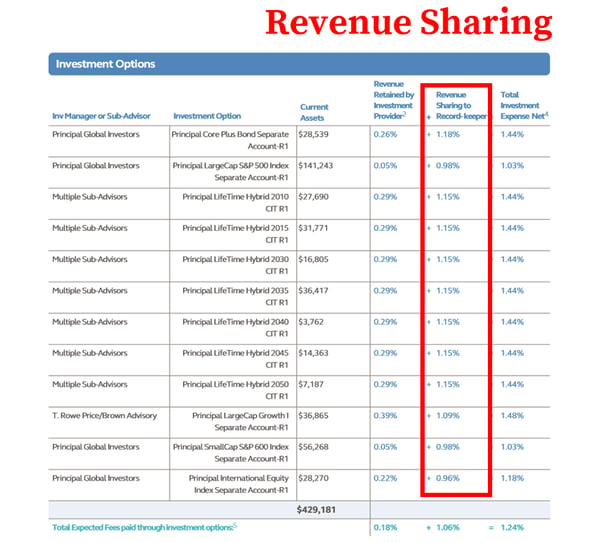

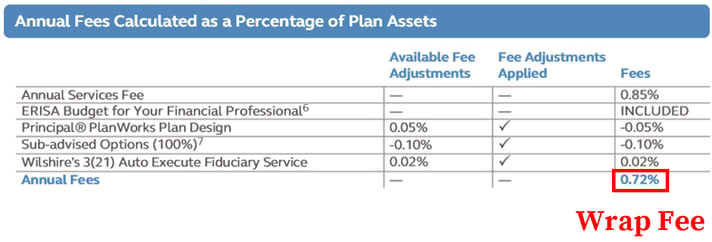

How To Find Calculate Principal 401 K Fees

How To Find Calculate Principal 401 K Fees

How To Find Calculate Principal 401 K Fees

How To Roll Over Your 401 K To An Ira Smartasset Saving For Retirement How To Plan 401k Plan

How To Find Calculate Principal 401 K Fees

Why Paying 401 K Loan Interest To Yourself Is A Bad Investment

3 Ways To Pay Off Your Debt Principal

How To Find Calculate Principal 401 K Fees

Use This Free 401k Loan Calculator To See If A 401k Loan Is Right For You

How To Find Calculate Principal 401 K Fees

Catch Up Contributions How Do They Work Principal

Making A Choice For Your 401 K Principal

Retirement Income Creating Your Own Paycheck Principal

How To Find Calculate Principal 401 K Fees